This article was co-published with the Detroit Free Press.

Baker College sells itself as a place where students thrive and lives are transformed: “a haven for those who dream big.”

From humble beginnings as a small business school in Flint, Baker rose to become the largest private college in Michigan, forging a presence in online learning and in Michigan towns where many students thought a college degree was beyond their grasp. For decades, the school’s marketing touted low costs and employment rates of nearly 100% for job-seeking graduates — making the dream seem both affordable and achievable.

But for many the Baker reality is neither, an investigation by the Detroit Free Press and ProPublica found.

What the college’s ads don’t say is that less than one-quarter of its students graduate — far below the national average for private four-year schools, according to federal data. Baker has the third-lowest graduation rate among 26 private four-year schools in Michigan.

The ads also don’t point out that 70% of Baker students who took out federal student loans have problems making payments two years after leaving college. An exceptionally large number of former Baker students with loans have filed claims with the federal government that they were defrauded or misled by the college.

Nor is there mention of the Baker students who find themselves struggling long-term after leaving the school. Ten years after enrolling, according to federal data, fewer than half of former Baker students made more than $28,000 a year, the lowest rate among schools of its kind in the state.

All this has occurred under the watch of a college oversight structure with unusually close ties to Baker’s leadership, the Free Press and ProPublica found. The joint investigation relied on public records, internal reports and more than 50 interviews, including with current and former students, faculty and employees.

The president of the college, records show, serves on its Board of Trustees, which is supposed to provide a check on the decisions of the school administration. And a retired Baker president served as chair of that board until very recently — at the same time being paid more than a million dollars from the college for five years of part-time work.

Education experts caution nonprofits against compensating board members, saying it can lead to decisions that are not in the best interest of students or the college.

“I’ve never seen the president of an institution become the chairman of the board after he retires,” said James Finkelstein, a professor emeritus of public policy at George Mason University who has studied higher education finances for decades. “It certainly is not doing best practices by any stretch of the imagination.”

The new board chair is another longtime Baker executive who previously served as the institution’s top academic officer and a campus president.

Some former students have no regrets about their time at Baker; they’re grateful for a teacher or adviser who came through for them when they needed it. “I think it is a great place for adult learners to engage,” said Jules Tarrant, who earned degrees from both Baker’s Flint campus and its online program. Thanks to a scholarship, the school helped her transition from a tumultuous home life. She now lives in Northern Virginia and manages a grocery store. “My friends and family can’t believe how successful I’ve been,” she said.

But others express frustration after seeing what was supposed to be a life-enhancing experience become a lifelong financial burden. They describe confusion about shifting academic requirements and a lack of career counseling. Or dismay about not getting their degrees. Sometimes, it’s pure anger.

After graduating from high school in 2013, Daniel Church pursued an ambitious bachelor’s/master’s degree program in computer technology at Baker but said the department began to lose faculty and fell into disarray. Intent on sticking it out, he took out loans to stay in school and navigated unexpected graduation requirements. Then, after six years, he gave up in defeat.

Today, Church drives a truck cross-country, with the hope that someday he can erase more than $30,000 he said he borrowed for a degree he never received.

“I will never get that time in my life back,” he said.

Baker officials, in response to questions, traced the school’s low graduation rate to its open enrollment policy of accepting virtually any applicant with a high school degree or GED. They also said the college is not allowed to restrict student borrowing.

In a statement to reporters, Baker emphasized a continuing commitment to improving student outcomes and reducing student loan debt, though it did not provide specifics. It did not comment for this story on the students or the experiences they described.

Bart Daig, Baker’s president and chief executive, talked to reporters last summer before declining additional interviews. He said he believes Baker’s marketing efforts — costing $9.7 million in the 2019-20 school year, more than the college spent on financial aid — are necessary because its breadth of educational opportunities are not well-known.

“We’ve been extremely modest over the years,” he said.

In 2019, Chief Operating Officer Jacqui Spicer gave a rare response to critiques of Baker when residents in Ferndale, outside Detroit, pushed back against the college’s plan to move its main campus there. Some complained at public meetings about Baker’s academic reputation and called the school predatory.

“Being predatory, I don’t think that’s the way in which we operate,” Spicer told a reporter at the time, adding: “We always put our students first, and I think it’s just disappointing people think that we’re predatory, because we really do have the students — they’re top of mind for us.”

Baker began as a for-profit school in 1911 but became a nonprofit in 1977, then entered a period of rapid growth. Since the recession, however, enrollment has been in a tailspin.

Competition in the online education market contributed to the erosion, as did its own decisions to close five campuses, including those in historically industrial communities like Flint and Allen Park, while eliminating most certificate and associate degree programs. It is now Michigan’s second-largest four-year private college by enrollment, after Davenport University.

The school’s search for a new campus signaled a major pivot, with Baker trying to appeal to more traditional students, especially those seeking bachelor’s degrees right out of high school.

After failing in Ferndale, Baker found a warmer welcome in Royal Oak, a well-off Detroit suburb, where it is building a $51 million flagship campus scheduled to open later this year. The marketing strikes a familiar theme of hope, tailored to a new audience. A YouTube ad highlights sophisticated labs and experienced instructors, along with disc golf, live music and sushi.

“Your path to your dream career begins at Baker College,” the ad declares.

Student Debt

Baker has long made affordability its selling point. Full-time undergraduate tuition is around $11,000 a year, cheaper than most of the state’s other private colleges.

That makes Baker “quite attractive for students who are concerned over the cost of college,” Daig said. One glossy ad champions a “quality education minus the long-term financial sacrifice.”

But most Baker students are low-income or the first in their families to attend college. They often turn to federal and private loans to pay a large chunk of their costs.

“We can’t stop them from taking a federal loan, which — it is not within our authority,” Daig said. “We can strongly encourage them not to do it, and we can package them with that institutional aid so they don’t need it. But a lot of times, they took it.”

Several students interviewed for this story portrayed their interactions with the school differently, saying Baker officials didn’t urge caution.

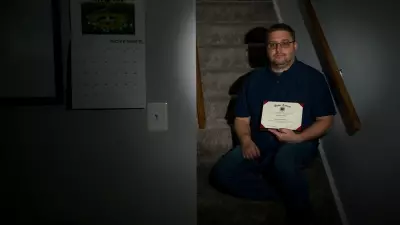

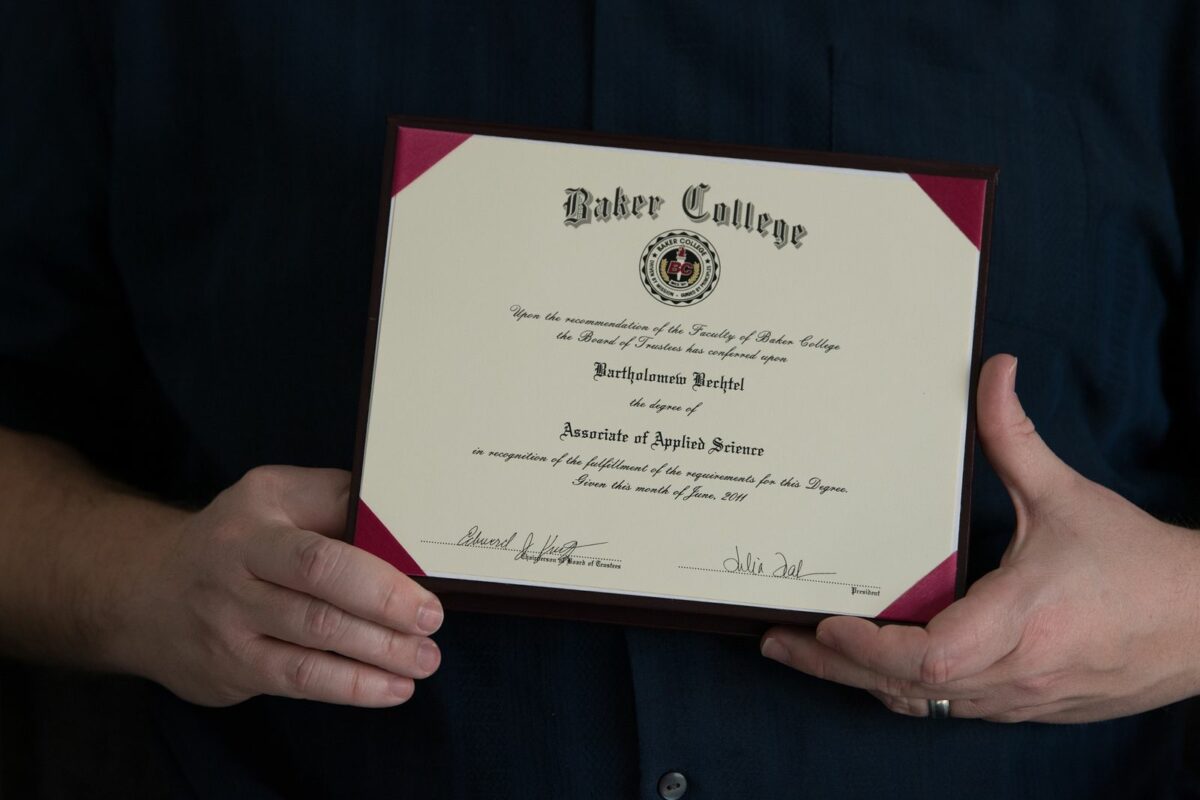

Bart Bechtel said he took out more than $40,000 in student loans while pursuing an online associate degree, with encouragement from Baker — even though the amount surpassed what he needed for tuition.

Financial aid officers, he recalled, told him he was eligible, so he might as well take advantage of the full amount. He said they talked about how he might need money for family expenses, his son and Christmas presents.

“We were going through a lot at the time with our son getting diagnosed as autistic, and Baker was very quick to suggest more and more financial aid to pay for things,” Bechtel said, referring to student loans. “So we became sort of dependent on them for that.

“It was not a good time or situation, and I feel like they took advantage of that.”

Dan Nowaczyk, who graduated from Baker’s Flint campus in 2016, recalled students talking about the extra spending money they could get from loans.

Once, he said, some students were talking about aid disbursement and one asked the others: “How much money did you guys get back?”

Nowaczyk recalled saying that he took out only enough money for classes and books. When the student said he came away with more than $10,000 beyond that, Nowaczyk said he felt obligated to tell him these were loans that had to be paid back — because the student didn’t seem to know.

“The financial aid department was not very good at explaining student loans,” he said.

Nowaczyk finished with a bachelor’s degree in information system security and $60,000 in debt, “less than I was expecting, so I’m not too upset,” he said. He now works at Kettering University in Flint as head coach of esports.

Jacqueline Tessmer, who taught digital media at Baker’s Auburn Hills campus for 14 years, saw the Baker experience backfire for low-income students who weren’t prepared for college. (Tessmer’s relationship with the school ended with a settlement after she filed a lawsuit for breach of contract and retaliation; in a countersuit, Baker disputed her claims.)

“Anybody got in,” she said. “If they could get financial aid, and they had a pulse, you could become a Baker student.”

But getting in was no guarantee of success, she said, and retention was a constant problem in her program. Students, she said, “were promised a better life but ended up with debt and no degree and no job in their chosen field.”

She added: “Baker College has ruined a lot of people’s lives.”

In its response to questions from the Free Press/ProPublica, Baker said financial aid award letters and loan request forms list each student’s maximum eligibility for federal loans, as regulations require, as well as “the reduced amount recommended to cover their institutional charges. This was done to reduce over-borrowing.” The college also provides students with aggregate loan totals and estimated monthly payments.

Baker also noted that if students took out private loans, these were disbursed without the college’s “awareness or involvement.”

If students don’t repay federal loans after leaving Baker, the government can garnish their wages, tax refunds and Social Security benefits. It can also hire collection agencies and file lawsuits to pursue payment. Unlike other forms of debt, federal student loans are extremely difficult to discharge in bankruptcy.

For Baker, the loans pose no risk or obligation. In fact, they provide a steady source of government-guaranteed revenue.

About 51% of Baker’s tuition revenue comes from federal student loans. Add in Pell Grants given to low-income students, which don’t have to be paid back, and about 72% of Baker’s tuition is backed by taxpayers.

By comparison, in the years before it shut down following federal penalties for predatory practices, ITT Technical Institute, a for-profit college system, relied on federal funds for about 76% of its revenue. Studies by several researchers have concluded that having a large percentage of tuition money coming from federal funds can be an indicator of a predatory for-profit school.

Davenport University, which Baker officials say is similar to their school, isn’t as reliant on public coffers. Only about 37% of Davenport’s tuition comes from federal loans. Including Pell Grants, about 49% of its tuition comes from the federal government.

Most nonprofit schools fundraise, seeking donations from successful alumni and others to reduce dependence on student debt. Not Baker. Its website states that “tuition is our sole source of income” — it doesn’t solicit donations.

“The financial aid department was not very good at explaining student loans.” — Dan Nowaczyk, 2016 Baker graduate

Student reliance on loans can also be reduced through generous financial aid, often supported by college endowments. And Baker, in fact, has a sizable one.

The Jewell Educational Fund, a nonprofit affiliated with Baker to help with financial aid and capital projects, has nearly $300 million in net assets. That gives Baker a wealthier endowment than Kalamazoo College in western Michigan, Seton Hall University or Gonzaga University.

But it hasn’t lessened the need for Baker students to go into debt, because Baker hasn’t aggressively spent the money on scholarships. Baker spends about 3% of the Jewell endowment earnings annually. Davenport, with an endowment of about $28 million, has a policy to spend 5% of its earnings each year.

In search of relief, former students can file claims with the U.S. Department of Education, saying they were misled when they borrowed the money. As of December 2020, according to data published by Yahoo Finance, of the 266 institutions with more than 100 “borrower defense” claims of deception, only five were nonprofits. The rest are for-profits and “covert for-profits,” where the moneymaking mission is clearer. “Covert for-profits” is a term that has been applied to colleges that very recently changed from for-profit to nonprofit, with little difference in how they actually operate. Among the five nonprofits that had a high number of claims, three are shuttered colleges, and one recently regained accreditation 20 years after losing it. The other is Baker.

Claims are not proof of wrongdoing, and Baker’s written response to reporters said the college has never been alerted to a successful application for borrower relief. Students file the claims under penalty of perjury. The Department of Education declined to answer questions about the claims against Baker, but it recently revived a borrower defense enforcement unit that had been dormant during the Trump administration.

Robert Niles, a former student with more than $83,000 in debt incurred while getting two associate degrees at Baker’s Cadillac campus, is preparing a borrower defense claim against the school.

He said he is citing Baker’s claims of 99% employment in the job market, which persuaded him to enroll because he believed it would give him his “best chance” at a better life. He will contend the training he received was insufficient for more than changing oil on cars.

For about three decades, Baker ads cited a “graduate employment rate” of nearly 100%. Its website, too, promoted this; it still claims “one of the highest available graduate employment rates in the country.”

When asked about the source for these numbers, Daig cited the National Association of Colleges and Employers. However, NACE said it does not evaluate individual institutions. It collects information that colleges self-report, often based on surveys. It would not comment on Baker’s claims. Baker’s public disclosure forms for certain programs say it calculates the employment rate using responses to a survey sent by the school to graduates.

It uses the same survey to estimate that its 2020 graduates with bachelor’s degrees make about $52,000 a year.

Niles first studied computer-aided drafting and design but said he couldn’t find a job in the field. Hoping to enhance his earning potential, he returned to Baker for training in automotive services. He graduated cum laude for both associate degrees.

But even with those credentials, he said, he earned just pennies more than what he had made previously as an auto mechanic intern. After graduating, he had to study on his own to obtain certifications for the skills he needed to make more. “It has nothing to do with any of those degrees,” Niles said.

One lesson from his time at Baker, he said, is this: “It’s just a business, you know. I mean, all Baker is is a business.”

College Structure

College presidents sit at the top of a management flowchart, but they do not typically operate without oversight. Independent boards of trustees serve as a check on decision-making and a judge of performance.

Recently, for example, the president of the University of Michigan announced he will leave the job sooner than expected — a move that coincided with rising tensions with the school’s Board of Regents, which questioned how he handled the pandemic and sexual misconduct scandals.

At Baker, Daig, the president, is actually a trustee, too. And the chair of the board through August was Daig’s predecessor as president, F. James Cummins.

Having ex-presidents as members of the board is a red flag, higher education experts said, because they are too closely tied to the operations of the college and their former colleagues.

“Essentially, this would make them their successor’s boss,” said Finkelstein, the higher education expert. “Regardless of whether they are being paid as a board chair, a university employee or just serving as a volunteer, this seems to be a unique situation and runs against virtually any principles of good governance.”

Baker did not answer repeated questions about whether Daig voted as a trustee. In its statements to reporters, Baker described its board as knowledgeable and involved, citing “constructive discourse and feedback.”

Meanwhile, the role of former president can be lucrative at Baker. In every tax filing by the college since Cummins retired in 2016 and joined the board, he has been one of the school’s most highly compensated individuals.

Cummins’ compensation for 2019-20 was $202,000 for a reported 22 hours of work a week. The tax filing said he played multiple roles, serving on the systemwide Board of Trustees and the Board of Regents, which provided guidance for branch campuses. Some state and federal filings also list him in a “secretary” position.

Ed Kurtz was 26 years old and Baker was still a for-profit school when it hired him as president in 1968. He led the school until 2002 and went on to serve about 13 years on Baker’s Board of Trustees, holding various titles, including chairman and vice-chairman.

During Kurtz’s time on the board — which overlapped with his two controversial stints as the state-appointed emergency financial manager of Flint — the college paid him more than $2.2 million for a reported 1 to 40 hours of work a week, for an average of about $170,000 a year.

Baker bylaws examined by reporters say that “no stated salary shall be paid to trustees, as such, for their services.” The bylaws do permit payment to a trustee who works for Baker College itself.

Former presidents have served as board chair since at least 1986, according to Cummins in a 2006 Flint Journal story.

Their leadership roles can stretch for decades. Robert Jewell, now 91, is a past president who owned Baker when it was a for-profit college. On documents, he was listed as a member of the Board of Regents of the Muskegon campus as recently as 2019. That year, the college paid him $10,450. Jewell could not be reached for comment.Baker said in its written responses that “Ed Kurtz and Jim Cummins received deferred compensation which was paid while serving on the board. Also, the Board Chair is an employee of Baker College.”

Demetri Morgan, assistant professor of higher education at Loyola University Chicago, said this type of arrangement is problematic.

“Board members are supposed to be free of any real or apparent conflicts of interests,” said Morgan, who studies how colleges are run. “Being a paid employee of Baker potentially impedes a board member from carrying out their fiduciary roles because the threat (perceived or real) of employment termination is more than enough to circumscribe one’s actions.”

Kurtz could not be reached for comment; Cummins declined to comment for this story.

“Board members are supposed to be free of any real or apparent conflicts of interests.” — Demetri Morgan, assistant professor of higher education at Loyola University Chicago who studies how colleges are run

Baker told ProPublica and the Free Press that as of Aug. 31 — three weeks after reporters asked questions about a possible conflict of interest — Cummins’ board tenure came to an end.

The new board chair is Denise Bannan, who retired in 2020 after 35 years as a top Baker executive. She has been provost, vice president for academics, president of the Owosso campus and Baker’s liaison to its accreditors. She made more than $300,000 in 2019-20, her last full year as an administrator, records show.

As for the other trustees, Baker doesn’t list them anywhere on its website or its student handbook — a potential problem for a student or anybody else who wants to contact the board with concerns about the way the college is run. When reporters asked who the current board members were, Baker declined to provide a list and instead recommended looking in the organization’s tax filings, which provide information for 2020 but nothing more recent.

Experts in higher education governance who reviewed Baker’s bylaws questioned whether any real checks and balances exist at Baker. “This is very atypical,” said Morgan.

So much so that when the Free Press/ProPublica asked Morgan to review Baker’s governance documents, he texted fellow researchers to see if they could think of any institution that was similar. They couldn’t.

Baker’s nonprofit status gives the college tax advantages, wider access to gifts and government aid and the ability to promote itself as having a public service mission.

But, George Mason’s Finkelstein said, “this looks more like a legacy structure for a for-profit enterprise. I have never seen a nonprofit college set up this way.”

Baker said its governance documents “have been and continue to be reviewed by accreditors, attorneys, accounting firms, etc. The articles of incorporations, bylaws, and governance structure are the result of professional advice designed to enable Baker College to fulfill its mission.”

The Higher Learning Commission, a private accreditation agency, found no flaws in oversight when it gave its most recent stamp of approval to Baker in 2020. “The Board operates independently,” it declared in its review.

The commission, which declined to comment for this story, based its conclusion on interviews and written documents, including the school’s bylaws. It also cited the minutes of trustee meetings, which describe the proceedings tersely.

The meetings reviewed by the commission occurred during a time of some of the most significant changes in Baker’s 111-year history, including the decision to close and sell four campuses and build a new one. Votes on all matters were unanimous.

Baker’s Many Incarnations

Baker prides itself on a long history of pivoting quickly and changing with the times.

As it grew, it began issuing not only certificates, but associate, bachelor’s, master’s and doctoral degrees. It expanded by buying business schools and Bible colleges across the state, while also making inroads in new communities and then broadening further through online education. In recent years, it bought a California-based online law school that it’s bringing under the Baker brand.

In 1999, Forbes applauded the college’s online efforts and revenue gains. “Such growth is impressive given that it has been achieved despite a complete absence of state or federal funding — even any fund-raising,” the magazine wrote.

John Matonich, a former member of the Board of Regents for Baker’s Flint campus, said one thing he always admired was the school’s nimble approach. “They recognized things pretty quickly, and they made changes when they needed to,” said Matonich, a retired CEO of Rowe Professional Services, a civil engineering consulting company.

Driven in large part by a massive online program, Baker grew from just shy of 4,000 students in 2000 to about 26,000 in 2015, dwarfing other Michigan private colleges.

Then, as more schools entered the online marketplace and demographic shifts meant fewer high school graduates, enrollment dropped. It slid to about 6,000 students in 2020, according to federal data. Enrollment for 2021 has not yet been reported.

Fewer students means less money. The school brought in $96 million in tuition for the 2017-18 academic year, according to audited financial statements. Two years later, it was $55 million.

This coincided with dramatic changes.

Baker shut down its campuses in Flint, Allen Park and Clinton Township in 2020, and will soon close one in Auburn Hills. The Port Huron campus quietly ceased operations two years earlier. Many campuses had received millions of dollars in recent renovations, including new dorms built at Port Huron three years before it closed. Baker also closed extension campuses in rural communities. A 2020 report delivered to accreditors affirmed that the school wanted to target “a more traditional student market that is academically prepared to succeed at the college level.”

Spicer told the Free Press in 2019: “We recognized that our business model wasn’t sustainable, and that’s one of the reasons that we’re making this shift.” She also said the school had “a lot of students who were at-risk,” which went “hand-in-hand with how our campuses have historically operated.”

The change in strategy at Baker doesn’t sit right with everyone.

Cleamon Moorer Jr., a former administrator and faculty member, observed with dismay as Baker shut down campuses and sought to attract different kinds of students.

“I think it’s insulting. I do,” said Moorer Jr., who served about three years as Baker’s first dean of a consolidated school of business. “Because now it’s almost as if you’re blaming the students for your institutional failures.”

Students Lost in the Shuffle

Baker’s dismal graduation rate almost certainly has something to do with the “at-risk” students Spicer mentioned — people who may come from low-income backgrounds, who didn’t excel in high school or who are balancing school, parenting and a full-time job.“

Open enrollment institutions generally do not have high graduation rates,” Baker officials noted to reporters in a written statement.

But for many students, the biggest hurdles placed in their way came from Baker itself.

Baker often starts programs, then changes them, moves them or shuts them down before students finish. It opened a campus in Reading, Pennsylvania, in 2016 that closed nine months later.

A common criticism among students is the lack of guidance once they begin school about everything from internships to graduation requirements. Students said they were on their own to find required internships. Baker once promoted “free lifetime placement service,” but recent graduates said they were simply referred to Handshake, an online platform.

“Baker College does have a Career Services department that continues to offer both current students and alumni assistance with social media profiles, resume writing, and career search and placement services,” Baker said in its response.

The department has four full-time and two part-time staffers. Davenport, which has roughly the same student population as Baker, employs 12 people full-time. It also makes use of Handshake and offers lifetime services.

Bechtel, the student who took on $40,000 in loans, earned an associate degree in web design but found his experience disappointing. Required courses, he said, taught computing languages he considered obsolete. When he reached out to student services — tutoring, tech support, career counseling — “they never returned my phone calls,” he said.

A year in, Bechtel said, Baker changed the requirements for his web design program without exempting current students. He’d taken required courses that no longer counted toward his degree. It bothered him, but he decided it wasn’t worth a fight.

More changes to the requirements came a year later, and then again the year after that. “I raised a whole lot of hell,” he said, until Baker waved him through with his existing credits.

Bechtel graduated in 2011. Neither the coursework nor the degree proved useful, he said. At home, he taught himself the programming language SQL, which got him jobs. He and his wife make decent salaries, he said, but his student debt — now up to $58,750 — has them living “paycheck to paycheck.”

“I’m not going to be able to retire because I’ll be paying these off,” Bechtel said.

Daniel Church, who enrolled out of high school as a full-time student in Flint, ran into trouble when Baker switched from quarters to semesters in 2017 to better align with other college calendars. In a booklet, Baker pledged the change would be cost-neutral and would “not disrupt your academic progress or increase your time to graduation.” But for Church, it did.

Church said he needed more time and money to finish getting bachelor’s and master’s degrees in Baker’s tech program. So he quit to work as a long-haul trucker, driving cross-country and saving paychecks.

He “didn’t go home,” he said, and “didn’t see anyone in my family. I worked my arse off.”

Church put aside thousands of dollars to pay for school. But when he got back to Flint, he learned he’d have to effectively repeat some of his quarter-based classes in the new semester system and complete an internship, costing him more than he had saved.

Baker gave him a list of leads, he said, but the companies he contacted weren’t taking interns. He decided it was time to give up on Baker.

“At that point, I just threw my hands up and laughed, because it was just so unbelievable,” said Church, who is now 27 and said he has more than $30,000 in loans. “How could any institution that expects itself to be taken seriously do this to people?”

After living in his parents’ house during the pandemic, he’s back to driving the truck.

Mariam Elba contributed research.

Agnel Philip of ProPublica and Kristi Tanner of the Detroit Free Press contributed to the data analysis.